Indicators on Action In Closing A Mortgage You Should Know

transfers possession of your new house from the vendor to you. Yes, there's a whole lot taking place, as well as a great deal of cash is going to change hands. Yet when you understand what to expect and also intend well, it can be a smooth, relatively low-stress experience.

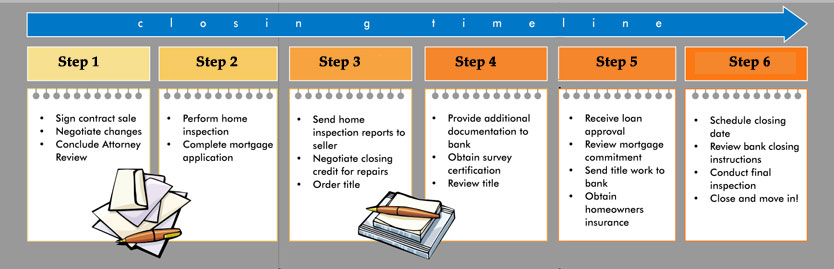

The home shutting procedure really starts as quickly as you as well as the seller have actually signed a purchase contract. Individuals typically describe this duration as being "in escrow." What's the timeline? Normally four to six weeks. In tight markets, nonetheless, it can be as long as 2 months, since it's more difficult for sellers to collaborate the sale of their residence with acquiring one more.

Closing on a home is a huge deal, yet it might really be much easier than locating one that you desire as well as can manage in the initial place. And also when it mores than, you leave with the secrets! As well as a home loan. To close the deal on your home, you need a closing representative (likewise called a settlement or escrow agent).

In a lot of states, the closing agent is a neutral 3rd party that benefits a negotiation business (frequently called an escrow firm or title firm). Occasionally you can select the business; this is typically discussed with the vendor. The standard Lending Quote develop you obtained after you used for your financing notes the closing services you can go shopping for (see page 2, area C).

10 Simple Techniques For Closing Process For Home Mortgages

Yet others require one to prepare only certain records, so you finish up with both a negotiation company and also a realty lawyer. Which states need a lawyer for all or part of the process? We wait to provide you a listing, considering that regulations alter all the time. A lot of them are eastern of the Mississippi.

Where a lawyer is optional, you might desire one anyhow. Unless you employ your own lawyer, there's no one at the closing who solely represents your lawful interests. If there's anything uncommon concerning the sale, certainly play it safe and employ one. Even the most effective realty agent is not a realty attorney.

Your state bar association may have a lookup. Per hour costs generally run from $150 to $350. Lenders need you to purchase house owners insurance as well as bring the policy to the closing. That coverage is pretty important to both you and them! As you can visualize, the expense of insurance coverage varies commonly depending upon the worth of your home, just how useful your stuff is, and also where you live.

Prior to you go shopping, take an appearance at these eight usual mistaken beliefs regarding home owners insurance coverage. When you get a home, you're buying the "title" to the residential property, which offers you single, clear possession. Title insurance coverage supplies security in the not likely yet possibly devasting occasion that a person else, sooner or later, makes a shock case on the residential or commercial property.

The Definitive Guide for Home Mortgage Closing Procedure

The crucial thing to recognize is that you require your own plan. Your lending institution will need you to purchase title insurance coverage to shield their financial investment, yet their plan does not cover you. Technically, it's optional for you, yet please do not hand down it. Without it, you can shed your residence as well as your whole financial investment if your title ever were tested.

The expense of a title insurance policy varies commonly around the country. The average is about $1,000. You can conserve money by purchasing both policies from the exact same company. Typically, the lender has a recommended insurance provider, however you have the right to select a various one. Before you can close, you have to fulfill all the conditions set by your lending institution.

Some problems could be specific to your financing, but basic ones include a clear title report, an evaluation figure that goes to the very least the amount of the loan, paperwork of your earnings, and evidence of insurance. If you end up being concerned about fulfilling any one of the problems, contact your funding officer ASAP.

Do on your own a favor as well as start your arranging, packaging, as well as other tasks early. You'll have sufficient on your mind on closing day without fretting about locating even more boxes. Below's a sanity-saving eight-week list for you. This essential file, a country wide standard form, itemizes the closing sets you back to both you and also the vendor and also describes key information concerning your finance.

Not known Incorrect Statements About Action In Shutting A Home Mortgage

The expenses displayed in the Closing Disclosure ought to resemble what you saw on the Car loan Estimate back when you obtained the loan. Any kind of shocks? Begin asking inquiries. The walk-through is a fast final take a look at your future home. Your agent will certainly arrange it, preferably for the exact same day you close.

The walk-through may be quick, yet it isn't just a procedure. Prior to you take ownership of the property, you require to see to it the vendor truly has actually relocated out and also left points in the condition you consented to. Every representative has tales: sellers that have not even started packaging, a wrecked image window ... If anything is amiss, your agent will hop on the phone quickly.

If the seller was meant to do anything significant, have actually the job examined by an expert prior to the walk-through. The closing agent (whether that's a settlement business or your attorney) will certainly send you a checklist of whatever you need to offer the closing. If you have any concerns, don't be reluctant to speak to the closing agent or your lender.

The mortgage and also various other files are authorized, repayments are traded, as well as lastly, the waiting is over: you obtain the secrets. If you have any unanswered concerns, this is your last chance. You'll be facing a rather big heap of paperwork. It's not so negative if you understand what's coming, so below's a brief guide to your shutting papers.

The Single Strategy To Use For Mortgage Closing Process

If your closing agent is your own lawyer, it will possibly be at their workplace. Who will be there? This differs depending upon where you live. Your property representative can inform you what to anticipate. Often there's an actual group, consisting of the closing agent from the negotiation business, your lawyer if you have one, the vendor's attorney if they have one, the loan provider's agent, the seller, as well as both realty representatives.

You might have the keys, yet you're refrained yet. After you close, it's clever to file a homestead affirmation, also called a homestead exemption. In some states, homestead is automatic, but don't presume. Ask your property representative or closing representative concerning it. A homestead declaration registers your residence with both the federal and also state federal governments as your main home and also shields it in different methods.

The details http://thelmadriscollperryshdk363.jigsy.com/entries/general/some-known-incorrect-statements-about-shutting--procedure-for-mortgages can be a little bit complicated, but homestead usually obtains you at least 3 sort of security: If you ever face personal bankruptcy, homestead can assist stop the forced sale of your house to pay debts, with the exception of the home mortgage (i.e. no assistance in a foreclosure circumstance), building and construction liens, as well as residential or commercial property tax obligations Excuses you from a certain quantity of residential or commercial property tax obligations Aids a surviving spouse stay in the home To submit, call your county assessor's workplace.